Mastering NYS Income Tax: A Comprehensive Guide For Everyday Heroes

Let’s face it, folks, taxes aren’t exactly the most exciting topic in the world, but when it comes to NYS income tax, understanding the ins and outs can save you a lot of headaches—and maybe even a few bucks. Whether you’re a New Yorker by birth or just someone trying to navigate the financial maze of the Empire State, this guide is here to break it down in a way that’s easy to digest. So, grab your favorite drink, sit back, and let’s dive into the nitty-gritty of New York State income tax.

Now, I know what you’re thinking—“Why do I need to know all this?” Well, my friend, knowledge is power, and in this case, it’s the power to keep more of your hard-earned cash in your pocket. The last thing you want is to get caught off guard during tax season or end up paying more than you have to. This article is designed to be your go-to resource for everything NYS income tax-related.

And don’t worry, we won’t bombard you with jargon or make your eyes glaze over with technicalities. We’re keeping it real, keeping it simple, and making sure you leave here feeling confident about your tax situation. Let’s get started, shall we?

Read also:Kirsten Toosweet Onlyfans Leaked The Untold Story You Need To Know

Table of Contents:

- Overview of NYS Income Tax

- Who Needs to Pay NYS Income Tax?

- Understanding Filing Status for NYS Taxes

- NYS Income Tax Brackets Explained

- Key Deductions and Credits for NYS Taxpayers

- Important Forms for Filing NYS Income Tax

- NYS Income Tax Deadlines You Should Know

- What Happens If You Miss the Deadline?

- How to Amend Your NYS Tax Return

- Where to Find More Resources on NYS Taxes

Overview of NYS Income Tax

Alright, let’s kick things off with the basics. NYS income tax is essentially the money you owe to the State of New York based on how much you earn in a year. It’s separate from federal income tax, though there are some overlaps that we’ll touch on later. Think of it as New York’s way of funding public services, infrastructure, and all the good stuff that keeps the state running smoothly.

One thing to note is that New York has its own set of rules and rates when it comes to income tax. Unlike some states that use a flat tax rate, New York operates on a graduated system, meaning the more you earn, the higher your tax rate. But don’t panic just yet—we’ll break it down step by step so you know exactly what to expect.

Why NYS Income Tax Matters

Here’s the thing: paying your NYS income tax isn’t just about avoiding penalties (though that’s definitely a good reason). It’s also about contributing to the community and ensuring that the state can continue to provide essential services like education, healthcare, and public safety. Plus, if you play your cards right, you might even qualify for some sweet deductions and credits that can lower your overall tax bill.

Who Needs to Pay NYS Income Tax?

Not everyone who earns money in New York has to pay state income tax. Generally speaking, if you’re a resident of New York State or if you earn income from sources within the state, you’re required to file and pay NYS income tax. But what does that really mean?

Resident vs. Non-Resident: If you live in New York for most of the year, you’re considered a resident taxpayer. That means you’ll need to report all your income, no matter where it comes from. On the flip side, if you’re a non-resident who only earns income in New York, you’ll only owe taxes on that specific income.

Read also:What Happened To Chuck Todd The Inside Scoop Yoursquove Been Waiting For

Special Cases

There are a few unique situations worth mentioning. For example, part-year residents—those who move in or out of the state during the tax year—may have to file both resident and non-resident returns. And let’s not forget about freelancers, gig workers, and remote employees, who often have additional considerations to keep in mind.

Understanding Filing Status for NYS Taxes

Your filing status plays a big role in determining how much NYS income tax you owe. Just like with federal taxes, there are several categories to choose from:

- Single: If you’re unmarried and don’t qualify for any other status, this is the one for you.

- Married Filing Jointly: Ideal for couples who want to combine their income and deductions on one return.

- Married Filing Separately: For those who prefer—or are required—to file separate returns.

- Head of Household: Typically used by single parents or individuals supporting dependents.

Choosing the right filing status can make a significant difference in your tax liability, so take the time to evaluate which option works best for your situation.

NYS Income Tax Brackets Explained

Now, here’s where things get interesting. New York uses a tiered system of tax brackets, which means your income is taxed at different rates depending on how much you earn. As of the latest data, the brackets range from 4% for lower-income individuals to over 8% for high earners.

Example: Let’s say you’re a single filer with an annual income of $50,000. Under the current NYS tax brackets, the first $8,500 would be taxed at 4%, the next chunk at 4.5%, and so on until you reach your total income. It’s a bit like climbing a staircase—each step gets a little steeper as you go.

How to Calculate Your Tax Liability

While it may sound complicated, calculating your NYS income tax isn’t as bad as it seems. Most tax software programs and online calculators can do the heavy lifting for you. However, if you’re the DIY type, you can always refer to the official NYS Department of Taxation and Finance website for detailed instructions and worksheets.

Key Deductions and Credits for NYS Taxpayers

One of the best ways to reduce your NYS income tax is by taking advantage of available deductions and credits. These are essentially tools that allow you to lower your taxable income or directly decrease the amount of tax you owe. Some popular options include:

- Standard Deduction: A fixed amount you can subtract from your income if you don’t itemize your deductions.

- Itemized Deductions: Allows you to deduct specific expenses like mortgage interest, charitable contributions, and medical bills.

- Child Tax Credit: Provides a credit for each qualifying child under the age of 17.

- Education Credits: Helps offset the cost of tuition and related expenses for students and their families.

Keep in mind that eligibility requirements vary for each deduction and credit, so be sure to double-check the details before claiming them on your return.

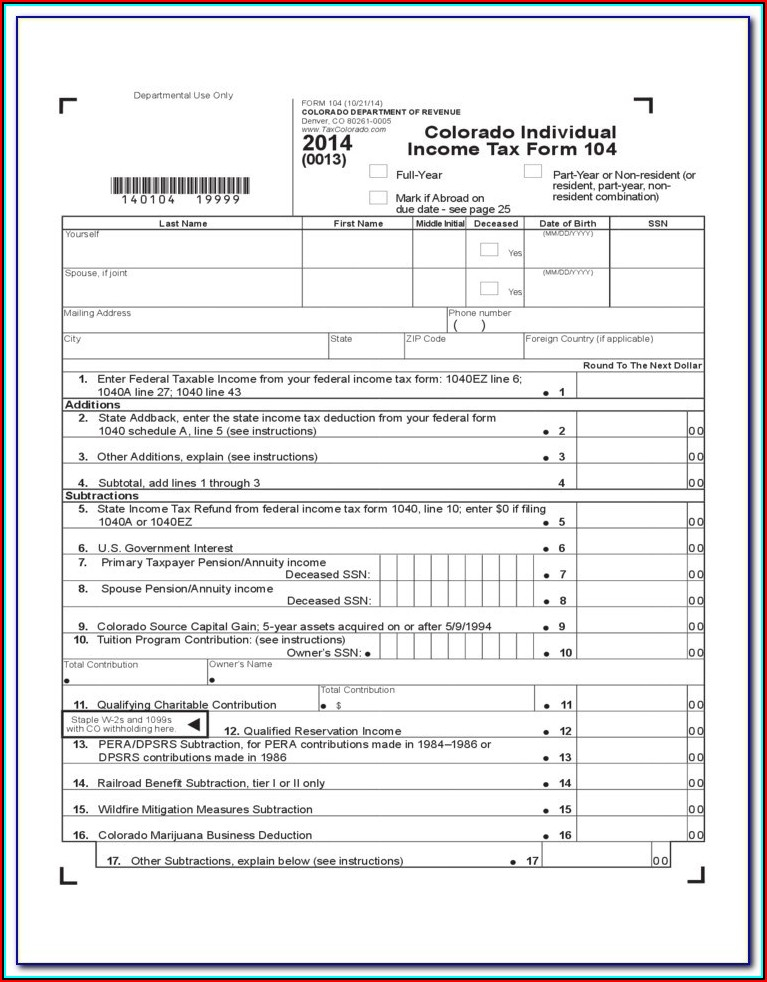

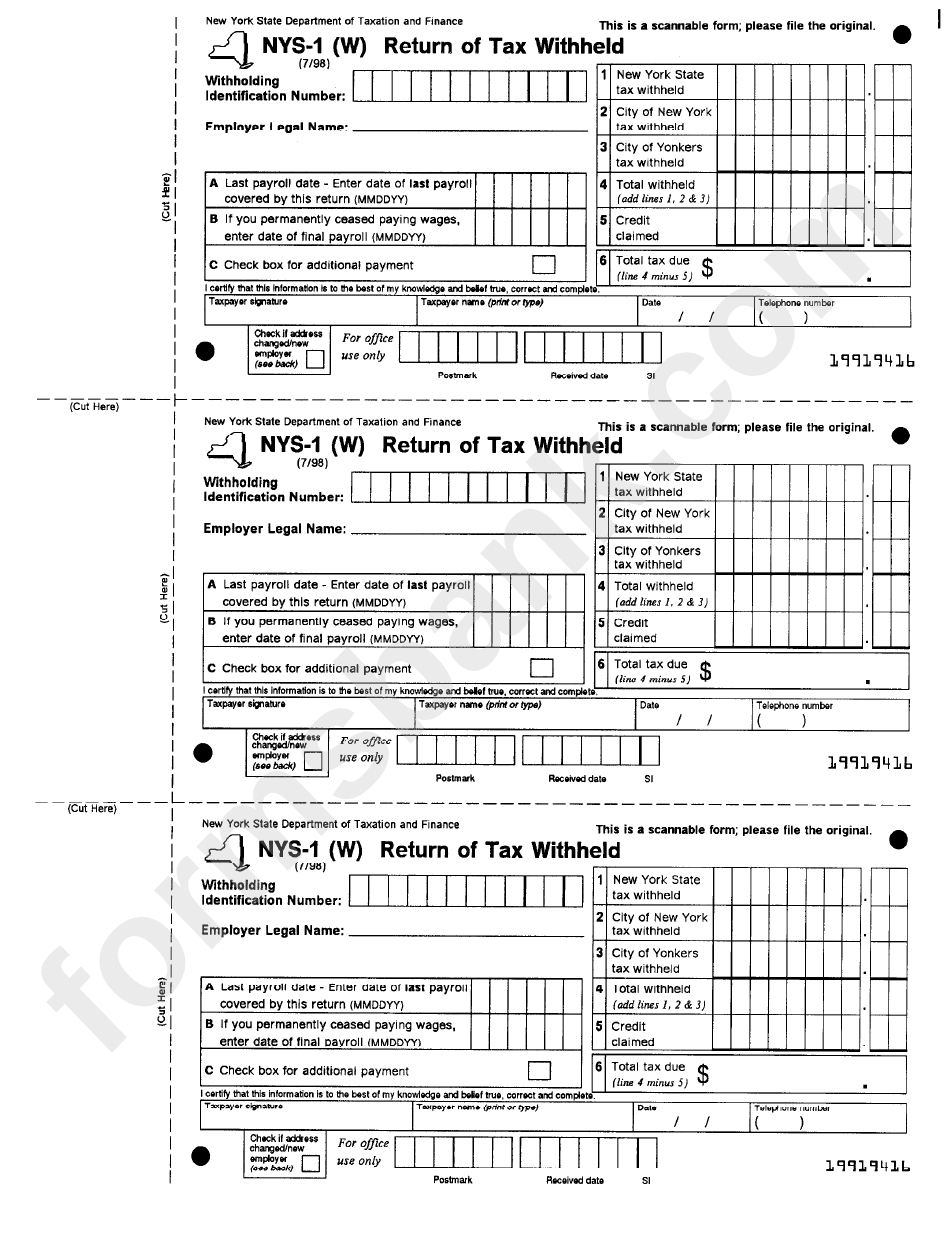

Important Forms for Filing NYS Income Tax

When it comes to filing your NYS income tax, having the right forms is crucial. The most common form is IT-201, which is used by residents to report their income and calculate their tax liability. Non-residents, on the other hand, will need to use Form IT-203.

Depending on your situation, you may also need to file additional forms, such as:

- IT-2105: For claiming certain deductions and credits.

- IT-214: For reporting estimated tax payments.

- IT-255: For claiming the Empire State Child Credit.

Make sure you have all the necessary forms before starting your tax preparation process. You can download them directly from the NYS Tax Department’s website or consult with a tax professional if you’re unsure which ones apply to you.

NYS Income Tax Deadlines You Should Know

Mark your calendars, folks, because missing a tax deadline can come with some serious consequences. For most taxpayers, the deadline to file your NYS income tax return is April 15th of each year. However, if you’re unable to meet that deadline, you can request an extension by filing Form IT-232.

Keep in mind that an extension only gives you more time to file your return—it doesn’t extend the time you have to pay any taxes owed. So if you expect to owe money, it’s a good idea to make an estimated payment by the original deadline to avoid interest and penalties.

What Happens If You Miss the Deadline?

Failing to file or pay your NYS income tax on time can result in penalties and interest charges. The exact amount will depend on how much you owe and how long you’re late, but trust me, it adds up fast. In extreme cases, the state may even take legal action to collect the outstanding balance.

The best way to avoid these headaches is to plan ahead and submit your return on time. If you’re struggling to meet the deadline, don’t hesitate to reach out to the NYS Tax Department for guidance or consider working with a qualified tax preparer.

How to Amend Your NYS Tax Return

Mistakes happen, even to the best of us. If you discover an error on your NYS tax return after it’s been filed, don’t panic—you can always amend it using Form IT-220. Be sure to include any necessary supporting documents and explain the reason for the change.

Amending a return can take longer than filing a new one, so it’s important to act quickly if you notice a mistake. And remember, you typically have three years from the original filing date to submit an amended return and claim any refunds you might be owed.

Where to Find More Resources on NYS Taxes

Still feeling overwhelmed? Don’t worry, you’re not alone. There are plenty of resources available to help you navigate the world of NYS income tax. Start with the official NYS Department of Taxation and Finance website, which offers a wealth of information on everything from filing instructions to tax law updates.

For personalized assistance, consider reaching out to a local tax professional or certified public accountant (CPA). They can provide expert advice tailored to your specific needs and help ensure you’re maximizing your deductions and credits.

Final Thoughts

There you have it, folks—a comprehensive guide to mastering NYS income tax. Whether you’re a seasoned pro or a first-time filer, understanding the basics and staying informed can make all the difference. Remember, paying your taxes doesn’t have to be a chore—it’s an opportunity to contribute to your community and secure a brighter financial future for yourself.

So, what are you waiting for? Take action today, share this article with your friends, and let’s work together to conquer the tax season like pros. After all, knowledge is power, and power is something we can all use a little more of. Cheers to happy filing!

Article Recommendations