Harshad Mehta: The Rise, Fall, And Legacy Of India’s Infamous Stock Market Scamster

Harshad Mehta, a name that once sent shockwaves through the financial world, is synonymous with one of India’s biggest stock market scandals. His story is a rollercoaster ride filled with ambition, greed, and ultimately downfall. In the early 1990s, Mehta was seen as a financial wizard who could make the stock market dance to his tune. But behind the glitz and glamour, there was a darker side to his success. This article dives deep into the biography of Harshad Mehta, exploring his rise to fame, the mechanics of his infamous scam, and the lessons we can learn from his life.

When you think about financial scandals, Harshad Mehta’s name is bound to pop up. His story is not just about money; it’s about the human tendency to push boundaries and the consequences that follow. From a small-time stockbroker to the man who almost brought down the Indian stock market, Mehta’s journey is both fascinating and cautionary.

So, why should you care? Understanding Harshad Mehta’s story can help you grasp the intricacies of the financial world and the dangers of unchecked greed. Whether you’re an investor, a student of finance, or simply curious about the dark side of capitalism, this biography offers valuable insights.

Read also:King Von Autopsy A Deep Dive Into The Life Legacy And Final Chapter

Table of Contents

- Early Life and Background

- Biography of Harshad Mehta

- Stock Market Career and Rise to Fame

- The Harshad Mehta Scam Explained

- The Fall of Harshad Mehta

- Aftermath of the Scandal

- Legal Battles and Trials

- Impact on Indian Stock Markets

- Lessons from Harshad Mehta’s Story

- Legacy and Final Thoughts

Early Life and Background

Harshad Mehta was born on November 12, 1954, in a small village in Gujarat, India. His family was not wealthy, and he grew up in modest circumstances. Despite this, Mehta had a knack for numbers and a sharp mind for business. After completing his education, he moved to Mumbai, the financial capital of India, to pursue a career in the stock market.

His early days in Mumbai were tough, but Mehta’s determination and hard work paid off. He started as a clerk at a brokerage firm and quickly climbed the ranks. By the late 1980s, he had established himself as a successful stockbroker, earning the nickname “The Big Bull.”

Key Facts About Harshad Mehta’s Early Life

- Place of Birth: Gujarat, India

- Education: Basic schooling, no formal finance degree

- First Job: Clerk at a brokerage firm in Mumbai

- Early Achievements: Quickly rose through the ranks in the stock market

Biography of Harshad Mehta

Let’s take a closer look at the man behind the scandal. Harshad Mehta was more than just a stockbroker; he was a charismatic figure who inspired both admiration and fear. His biography reveals a complex personality driven by ambition and a desire for success.

Here’s a quick rundown of his life:

| Category | Details |

|---|---|

| Full Name | Harshad Shantilal Mehta |

| Date of Birth | November 12, 1954 |

| Place of Birth | Gujarat, India |

| Profession | Stockbroker, Financial Scamster |

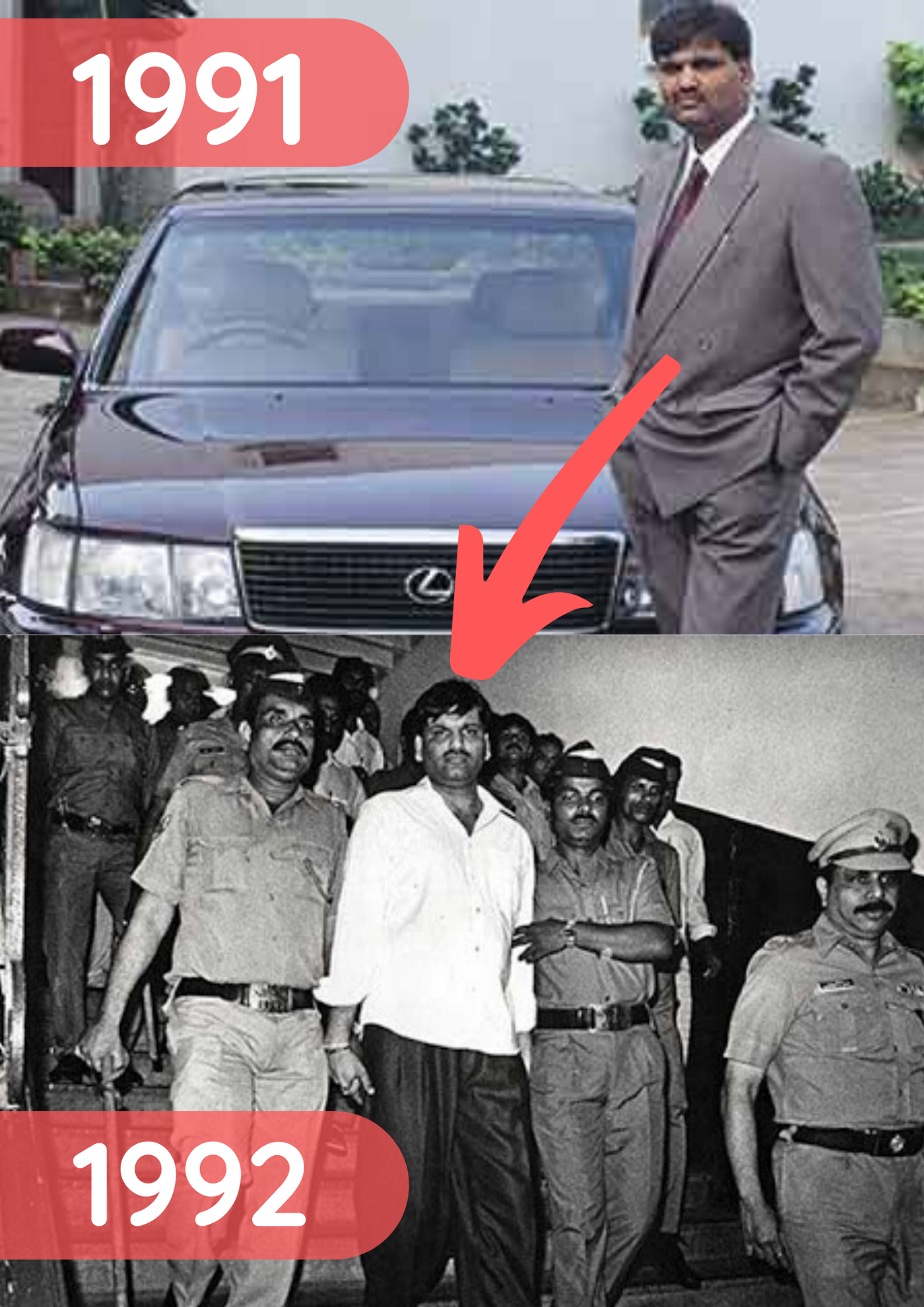

| Famous For | 1992 Stock Market Scam |

| Death | June 16, 2001 (Heart Attack) |

Stock Market Career and Rise to Fame

Mehta’s career in the stock market was nothing short of meteoric. By the early 1990s, he had become a household name in India. His ability to predict market trends and make profitable trades earned him a loyal following. Investors flocked to him, hoping to ride the wave of his success.

But what made Harshad Mehta so successful? It wasn’t just his financial acumen; it was also his ability to manipulate the system. He exploited loopholes in the banking and financial regulations of the time, using fake receipts and circular trading to inflate stock prices. This strategy, known as the “Ready Forward” scam, allowed him to control the market and make massive profits.

Read also:Is Noah Galvin Trans Exploring The Facts And Clearing Up The Confusion

How Did He Do It?

- Used fake bank receipts to borrow large sums of money

- Engaged in circular trading to create artificial demand

- Collaborated with brokers and banks to manipulate stock prices

The Harshad Mehta Scam Explained

The scam orchestrated by Harshad Mehta was one of the most elaborate in financial history. It all started with the “Ready Forward” transactions, where banks would lend money against fake bank receipts. Mehta used this money to buy large quantities of stocks, driving up their prices.

As the scam unfolded, the value of the Indian stock market skyrocketed. But it was all built on a house of cards. When the bubble burst in 1992, the market crashed, leaving thousands of investors ruined. The scam resulted in losses estimated at over $2 billion, a staggering amount at the time.

The Mechanics of the Scam

- Manipulated bank receipts to secure loans

- Used borrowed funds to inflate stock prices

- Created a false sense of security among investors

The Fall of Harshad Mehta

As the scam came to light, Harshad Mehta’s world began to crumble. Investigations by the Securities and Exchange Board of India (SEBI) revealed the extent of his wrongdoing. Mehta was arrested and faced multiple charges, including fraud and conspiracy.

Despite his fall from grace, Mehta remained defiant. He claimed that the system was flawed and that he was merely a victim of circumstances. However, the evidence against him was overwhelming, and he was eventually convicted of several charges.

Key Moments in His Fall

- 1992: The scam is exposed, leading to a market crash

- 1993: Arrested and charged with multiple offenses

- 1995: Convicted on several counts of fraud

Aftermath of the Scandal

The aftermath of the Harshad Mehta scam had far-reaching consequences. It led to significant reforms in the Indian stock market, with SEBI implementing stricter regulations to prevent similar incidents in the future. The scandal also highlighted the need for transparency and accountability in financial markets.

For the investors who lost everything, the aftermath was devastating. Many were left with nothing, their life savings wiped out in a matter of days. The trust in the stock market was shattered, and it took years for confidence to be restored.

Reforms After the Scandal

- Stricter regulations on bank receipts

- Increased oversight by SEBI

- Improved transparency in financial transactions

Legal Battles and Trials

Harshad Mehta’s legal battles were as dramatic as his rise to fame. He fought tirelessly to clear his name, even as the evidence mounted against him. The trials dragged on for years, with Mehta using every legal loophole to delay proceedings.

Ultimately, justice caught up with him. Mehta was convicted on several counts of fraud and sentenced to prison. However, he never served his full sentence, as he passed away in 2001 due to a heart attack.

Legal Milestones

- 1993: Arrest and initial charges

- 1995: Conviction on fraud charges

- 2001: Death before completing his sentence

Impact on Indian Stock Markets

The impact of the Harshad Mehta scam on the Indian stock market was profound. It led to a complete overhaul of the regulatory framework, with SEBI playing a more active role in monitoring market activities. The scandal also raised awareness about the dangers of unchecked greed and the importance of ethical practices in finance.

Today, the Indian stock market is one of the most regulated in the world, thanks in part to the lessons learned from the Harshad Mehta scandal. Investors are better protected, and transparency is a top priority.

Lessons from Harshad Mehta’s Story

So, what can we learn from Harshad Mehta’s story? First and foremost, it’s a reminder of the dangers of greed and the importance of ethical behavior in finance. Mehta’s downfall was not just his own; it affected thousands of innocent investors who trusted him.

It also highlights the need for robust regulatory frameworks to prevent such scandals in the future. The financial world is complex, and it requires constant vigilance to ensure fairness and transparency.

Key Takeaways

- Greed can lead to catastrophic consequences

- Regulation is essential for protecting investors

- Ethical behavior is crucial in the financial world

Legacy and Final Thoughts

Harshad Mehta’s legacy is a complicated one. On one hand, he was a financial genius who understood the intricacies of the market better than most. On the other hand, his actions caused immense harm to countless people.

As we reflect on his life, it’s important to remember the lessons he taught us. The stock market is a powerful tool, but it must be used responsibly. The Harshad Mehta scandal serves as a cautionary tale for anyone who believes they can manipulate the system for personal gain.

So, what’s next? Take a moment to think about how you can apply these lessons in your own life. Whether you’re an investor, a business professional, or simply someone interested in finance, the story of Harshad Mehta offers valuable insights.

Feel free to share your thoughts in the comments below or explore more articles on our site. Let’s keep the conversation going!

Article Recommendations